Diện tích hình tròn là gì? (Diện tích thương được viết tắt là S hoặc DT). Bài viết sau đây sẽ gửi tới các bạn 3 phần là định nghĩa, công thức tính và 4 bài tập ví dụ cơ bản thường gặp nhất trong các bài toán về hình tròn. Hy vọng bài viết sẽ hữu ích với bạn.

Tóm tắt nội dung

Định nghĩa?

Diện tích hình tròn là phần diện tích nằm bên trong đường tròn. DT hình tròn được nghiên cứu bởi người Hy Lạp cổ đại vào TCN. Người ta đã nhận ra rằng, DT hình tròn tỉ lệ thuận với bình phương bán kính của nó.

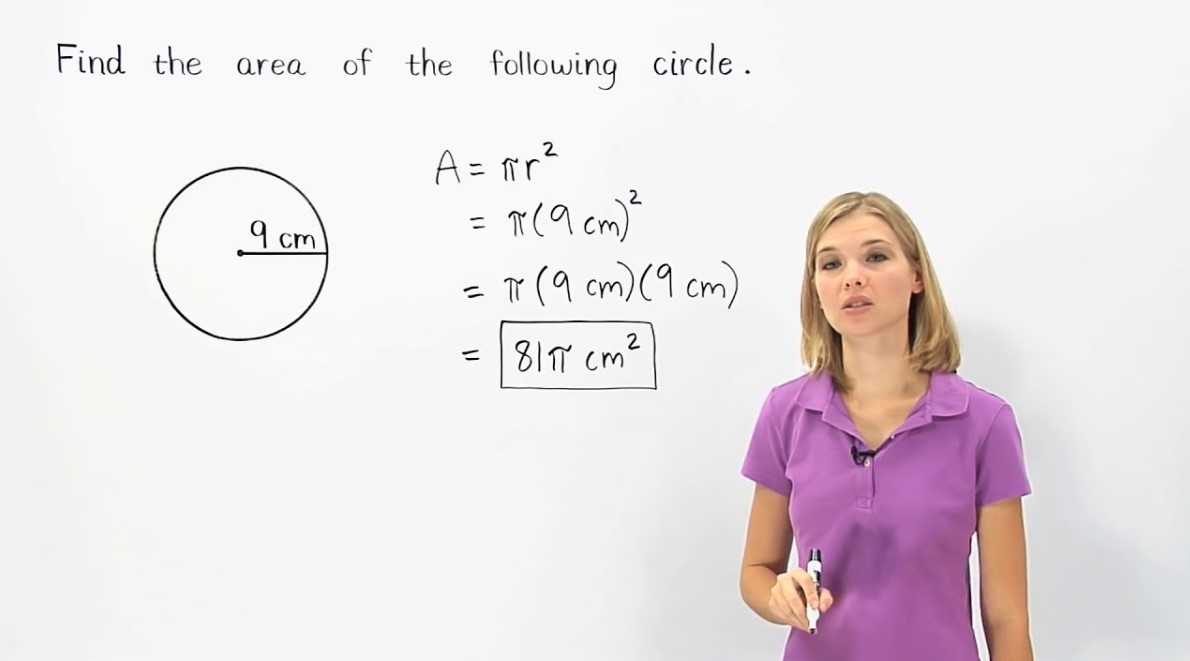

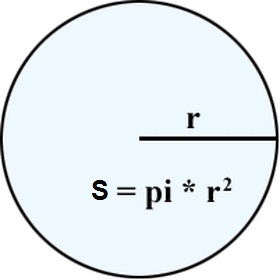

Công thức diện tích hình tròn

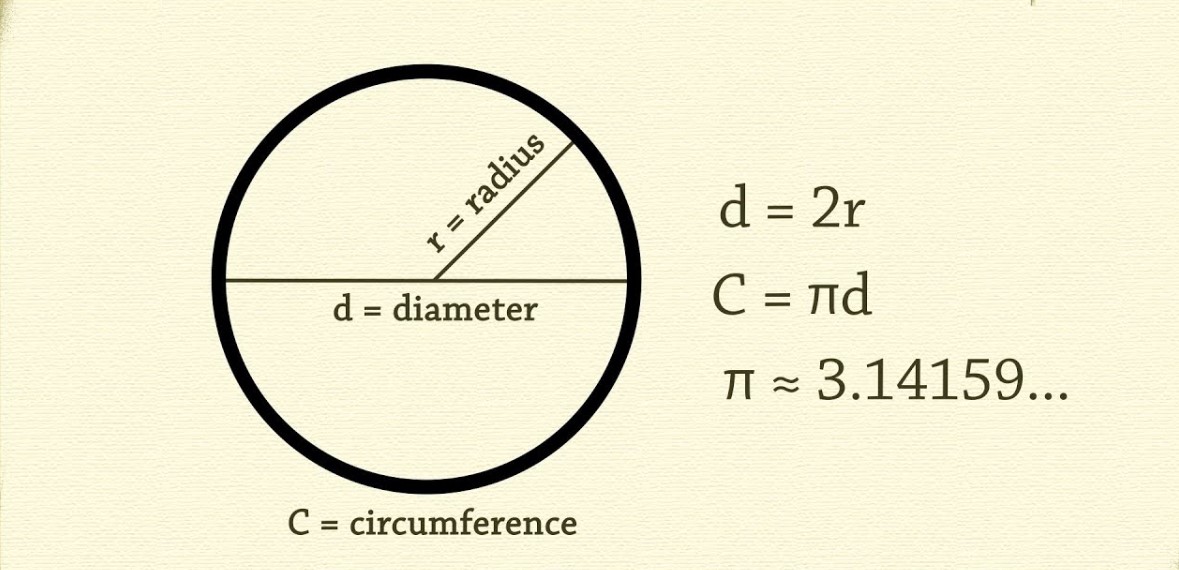

Diện tích hình tròn được xác định bằng tích giữa số pi và bình phương bán kính của nó.

S = πR2

Trong đó:

- S: là kí hiệu đại diện cho diện tích đường tròn

- π: là kí hiệu sô pi, với π = 3,14

- R: là bán kính hình tròn

Nhận xét: Để tính được S ta cần phải biết bán kính của hình tròn đó.

Một số đại lượng giúp ta tìm ra giá trị bán kính của hình tròn và S của nó:

- Đường kính hình tròn: d = 2R => R = d/2 => S = πd2/4

- Chu vi hình tròn: C = πd = 2πR => R = C/2π => S = C2/4π

- Cách tính diện tích nửa hình tròn rất đơn giản, chỉ cần lấy công thức trên chia cho 2.

Bài tập về cách tính diện tích hình tròn

Tính s hình tròn từ đường kính d

Bài 1: Cho hình tròn C có đường kính d = 16 cm. Hãy tính S(diện tích) hình tròn C?

Giải: Ta có, bán kính bằng một nữa đường kính theo công thức: R = d/2

<=> R = 16/2 = 8 cm

S hình tròn C: S = πR2 = 3,14.82 = 200,96 cm2

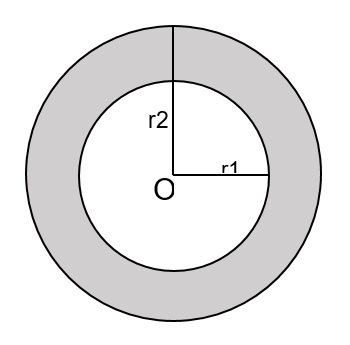

Tính diện tích hình vành khăn

Bài 2: Tính diện tích phần tô màu xám trong hình vẽ bên dưới đây. Biết, đường tròn lớn bao quanh bên ngoài có bán kính r2 = 15 cm và đường tròn nhỏ bên trong có bán kính r1 = 10 cm.

Giải: Nhận xét: Từ hình vẽ ta thấy, diện tích phần tô màu xám trong hình bằng hiệu của S hình tròn lớn bán kính r2 và DT(diện tích) hình tròn nhỏ bán kính r1.

– S hình tròn nhỏ:

S1 = πr12 = 3,14.102 = 314 cm2

– DT hình tròn lớn:

S2 = πr22 = 3,14.152 = 706,5 cm2

– Diện tích hình màu xám trong hình:

S = S2 – S1 = 706,5 – 314 = 392,5 cm2

Tính diện tích hình bất kỳ có chứa 1 phần diện tích hình tròn

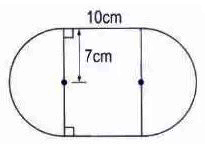

Bài 3: Tính diện tích toàn bộ hình vẽ bên dưới?

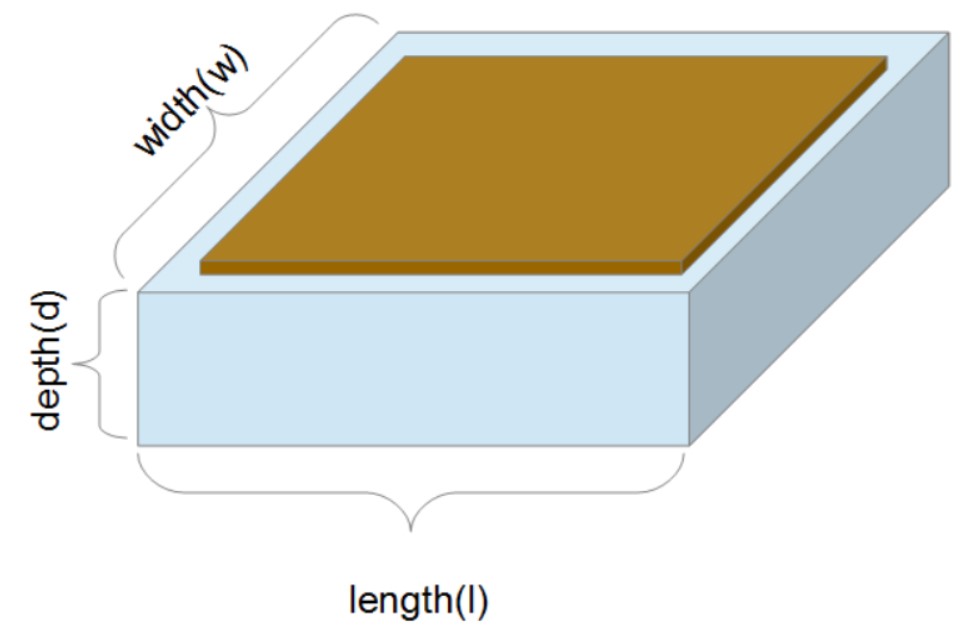

Giải: Ta thấy, diện tích của hình trên bao gồm diện tích 2 nữa hình tròn bán kính r =7 cm và diện tích của hình chữ nhật kích thước 10×7 cm.

– Diện tích hình chữ nhật: S1 = 10 x 7 x 2 = 140 cm2

– Diện tích hai nữa hình tròn cùng bán kính: S2 = πR2 = 3,14.72 = 153,86 cm2

=> Diện tích hình đã cho: S = S2 + S1 = 140 + 153,86 = 293,86 cm2

Bài toán tính S từ d nâng cao

Bài 4: Tính S hình tròn, biết nếu tăng đường kính đường tròn lên 30% thì DT hình tròn tăng thêm 20 cm2

Giải: Nếu tăng đường kính của hình tròn lên 30% thì bán kính cũng tăng 30%

Số % S(diện tích) được tăng thêm là:

(130%)2 – (100%)2 = 69%

Vậy diện tích hình tròn ban đầu là: 20×100/69 = 29,956 cm2

Ngoài ra, đối với những bạn có nhu cầu tìm hiểu thêm về kiến thức tiếng Anh có thể ghé sang website Bacsiielts.vn để được tư vấn, hỗ trợ lộ trình học từ cơ bản đến nâng cao nhé.